Considerations when buying US real estate

Recent Studies show that the number of International Private Clients buying US real Estate, particularly in Florida, Texas, and California has rising steadily. This is a very strong trend that looks likely to continue, however investors must be very careful to structure these investments to mitigate the risk of expensive surprises.

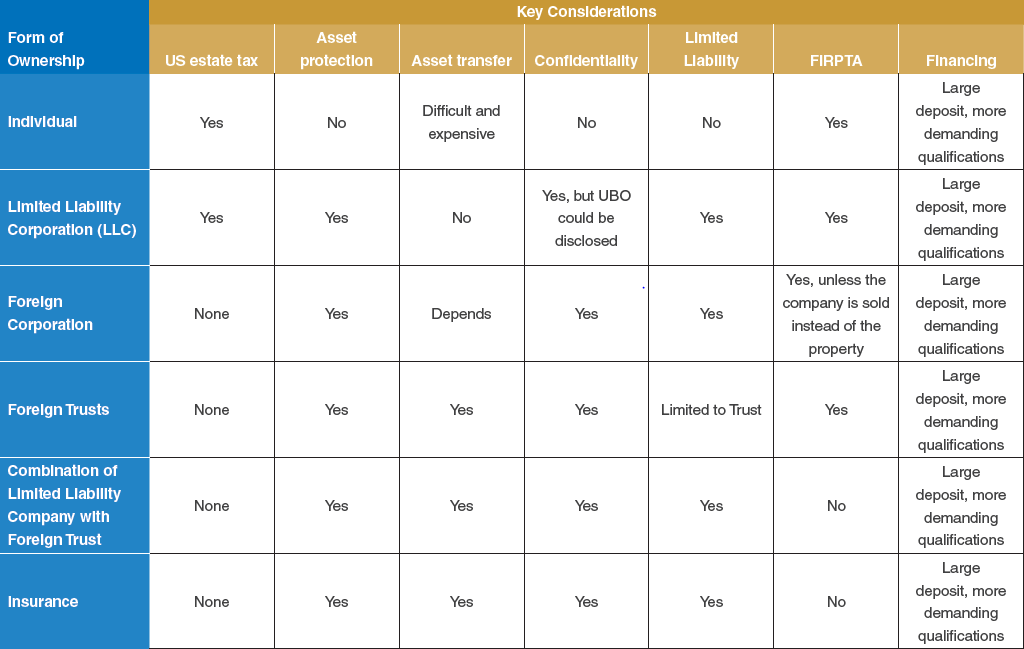

Key planning highlights to consider when purchasing US real estate:

U.S. Estate Tax

US real estate can be subject to US estate taxes even though the foreign investor’s estate maybe offshore. The US taxable estate of an international investor can be taxed at rates up to 40% of the value of the property in excess of a $60,000 exception. Tax treaties that are in place between the US and some foreign countries could determining breaks in tax rates.

Public records and confidentiality (beneficial ownership)

In the US, the name of the buyer and possibly also of the beneficial owner of a property will appear in the public records where the property is located.

Asset transfer & asset protection

The public records could be in contradiction with the international private client’s wish for privacy and protection of the asset for the future generation.

FIRPTA

The Foreign Investment in Real Property Tax Act (FIRPTA) requires that an international investor disposing an interest in US real estate can be subject to withholding, for tax purposes, of 15% of the gross sale price (i.e., $45,000 on a property with a sales price of $300,000). The amount is required to be forwarded to the IRS, by the agent, within 20 days of the date of closing. These funds are held until the IRS is satisfied that all taxes due by the international investment are paid.

Finance

If a buyer lacks US credit history, salary certificates or US tax returns, US lenders will apply stricter standards and a more rigorous process to foreign buyers seeking to purchase a US property with a mortgage. This may include requests for extensive records of other assets to qualify for a mortgage. International investor should also expect to make a down payment in the range of 30-50 percent of the purchase price.

Strategies & Solutions

Finding the right structure to balance the client’s goals (taxation, asset protection, privacy, financing)

Reasons why an international client would like to buy US real estate vary. It is key to find out what the clients goals are in order to find the appropriate structure. There are structures that can provide asset protection and privacy, and there are structures that focus more on taxation. And investors’ goals and circumstances will determine the optimal solution.

Cost of solution

The most complex and expensive structure is not always the most appropriate solution. The costs for a structure have to be in line with the value of the US real estate, the investor’s wealth and personal goals.

Possible solutions

Limited Liability Corporation (LLC)

The name of the LLC would appear in the public records as the buyer of the US property. Because LLCs are so-called look-through companies the company owner has to files a US tax reporting and consequently, the US property could be part of the international client’s estate. This structure focus on privacy, asset protection and costs, but does not address estate tax and taxation in general.

Foreign Corporation

The foreign corporation would appear in the records as the buyer of the US property. The foreign company does not have to file US taxes, but the international client as the owner/shareholder of the company might has to do a US reporting. The use of a foreign company could address the US estate tax, the privacy and the asset protection goals, but does not do much on taxation.

Foreign Trusts

If the foreign trust is the buyer of the US property, then the name of the international investor would not appear in the public records, and more important, the US property will not be part of the international client’s estate. This structure focus on estate tax, taxation, privacy and taxation.

Combination of LLC with Foreign Trust

This structure is more complex and more expensive but could be interesting for an international client who wishes to do large investments on the US property markets and is looking for a structure that address all key considerations.

Insurance

The use of an insurance policy to buy the US real estate could make sense if the International client would like find a solution focusing on taxation, US estate tax, and protection from potential creditors. The solution would not include primary residences.

Summary

The US tax code contains numerous advantages and traps for a foreign investor. It is important for the international clients to understand how the US estate tax; capital gains and income tax rules affect his US real estate investment and what may be done to minimize US taxes. Each international investor is different and unique and therefore it is necessary to find the tailored solutions that fits his goals and circumstances.