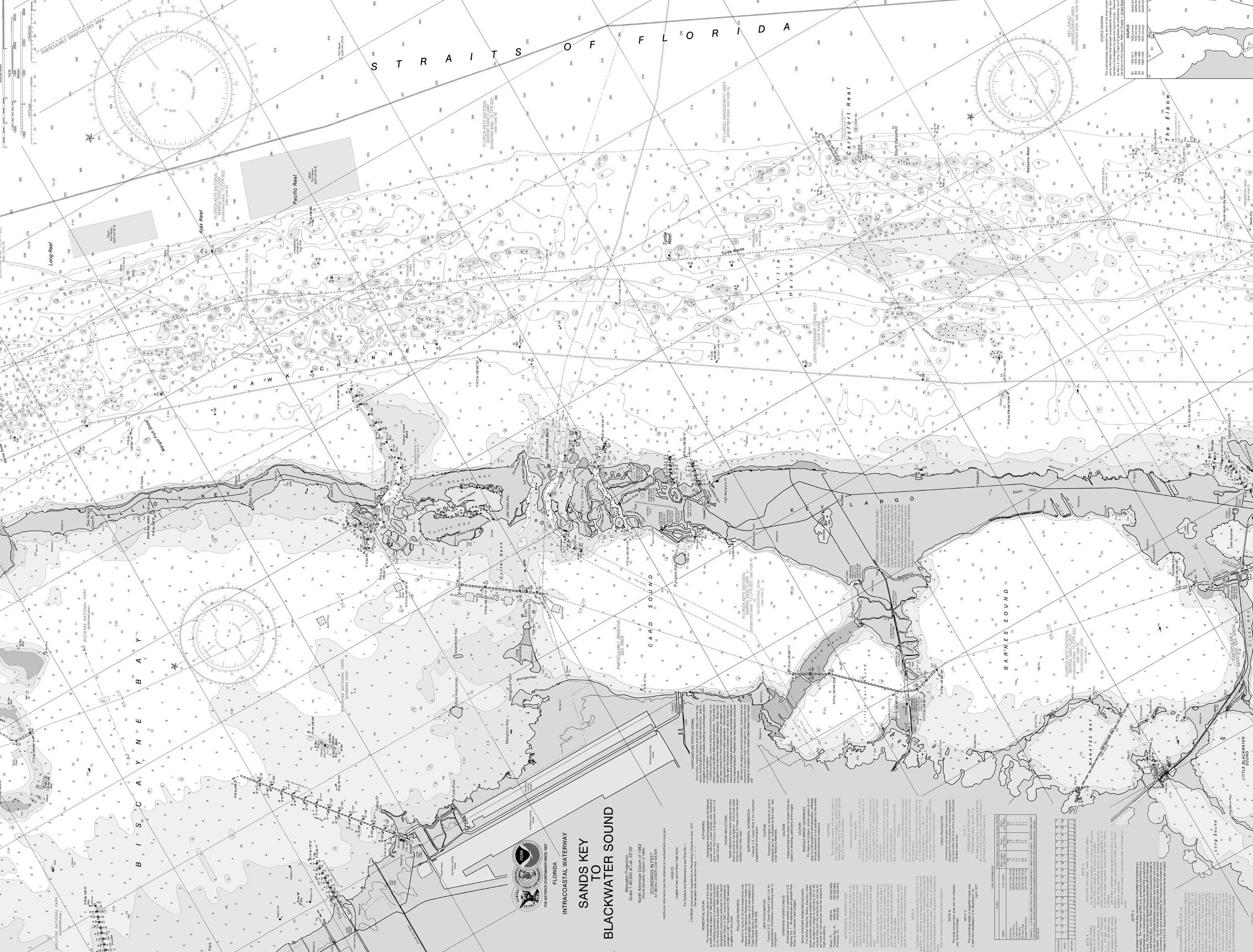

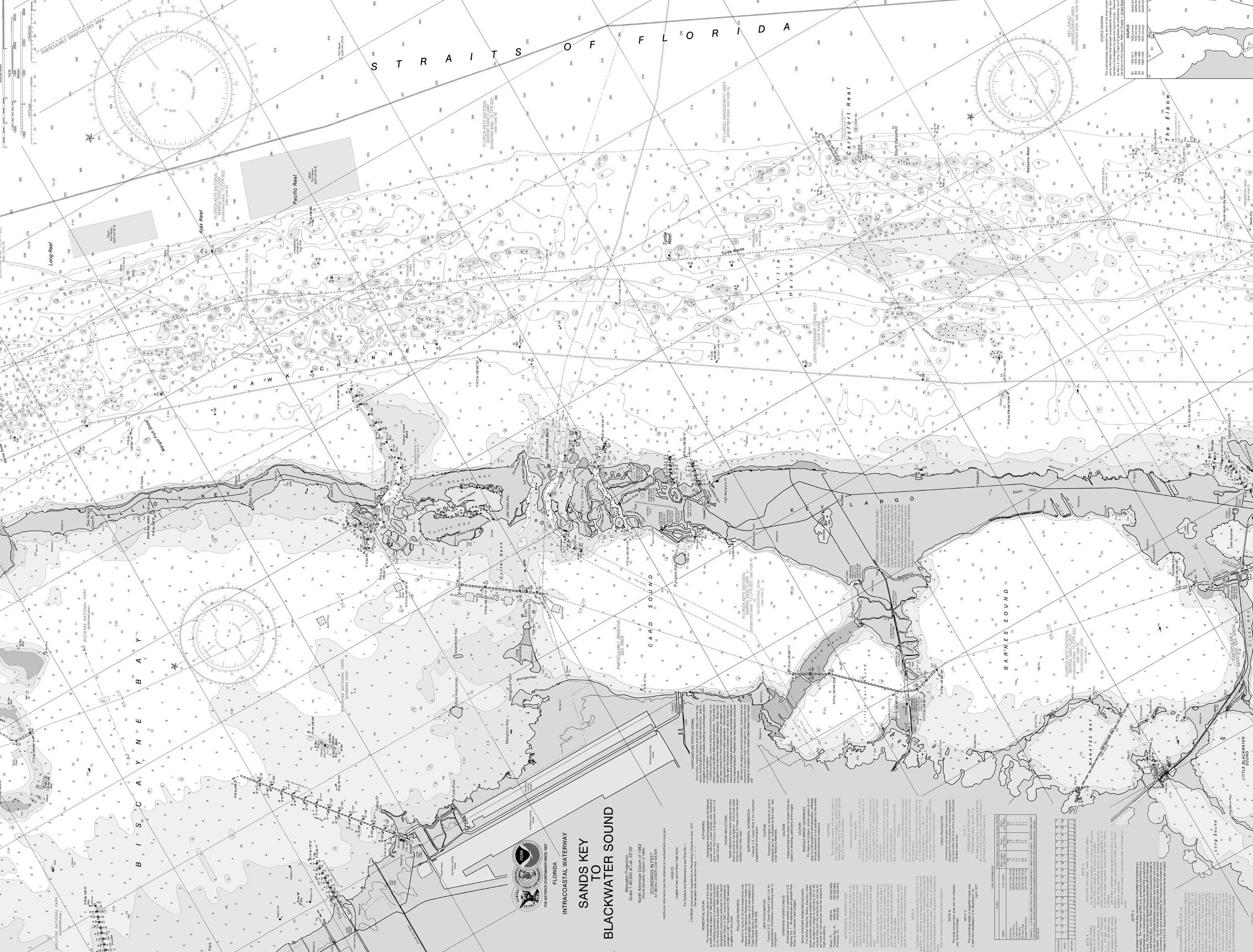

PRIVATE OFFICE

Rooted in Pilotage’s venturous community, Private Office guides enterprising, privately held organizations — from structural planning to corporate and capital advisory. We apply objective, seasoned global acumen to enhance value, mitigate risk, and drive efficiency.

STRUCTURE ADVISORY

-

When your assets are spread throughout the world and tax regulations that are constantly changing, we simplify the complex. We aim to deliver harmony for you and your company with tax residency & domicile options, manage the transition, and assist with any new tax obligations.

-

Unforeseen circumstances happen and can upend even the most basic objectives. Advanced planning with trusts, foundations, insurance, and corporate vehicles can be a challenge – our experienced advisors aim to ensure your interests are protected in a redundant framework.

-

Based on the advanced planning designs conceived between our clients and our advisors, we administer and deploy a variety of structures with established and pedigreed fiduciaries, risk underwriters and fund/specialty structures within our curated network.

STRUCTURE ADVISORY

CORPORATE ADVISORY

-

Based on our client’s investment thesis, we provide an analysis on value proposition, market position, financial, historical and trending data to provide basis on key decisions. Our back office and accounting services presents factual understandings for our client’s evaluation needs.

-

Unlocking growth, providing the benefits of scale and finding alignment is a complex process requiring coordination of legal, fiscal and financial agreements to achieve a successful transaction. We consult private organizations from culture to exchange ratios to find the right fit.

-

We help and consult shareholders of private organizations to establish cohesion between management and the board by enabling aligned strategic vision, balancing resources and risks; and enduring governance policies.

CAPITAL ADVISORY

-

Private investment banking advisory services for entrepreneurs, SMEs, family offices, as well as institutional investors by providing in-depth financial and strategic analysis, identifying optimal potential transaction partners, developing creative deal structures, and negotiating complex cross-border transactions.

-

We consult on synchronizing and the timing of capital structures of a private enterprise’s cycle from early stage equity private placements to qualifying for debt syndication. As guides to founders and shareholders we help harness the power of capitalism.

-

We consult on transactions using financial collateral, financial guarantees and securitization to deliver structured and leveraged banking needs. Combined with trade platforms and private placements to allow projects and trade deals to reach there full economic potential.