What You Need to Know About Independent Asset Managers in Switzerland.

Original Report published September 2015

Swiss IAMs in Brief: People and Offering

Decades ago, individual private bankers or small teams of bankers left banks to start up their own firms, using banks as custodians to house client assets. This is how most Independent Asset Managers (IAMs) in Switzerland were created. As a result, IAM advisors tend to be mature and have existing client experience, with long-established client relationships in most cases. IAM advisors understand the business when joining or forming an IAM, and their experience is valuable to clients. Their understanding of and focus on client needs and potential solutions is at the heart of their value proposition: independence, aligned interest, and personal service.

IAMs offer clients a range of wealth management solutions and advice, with asset management at the core. Asset management solutions range from discretionary mandates, directly managed by the IAM, to advisory mandates, where clients make portfolio decisions under advice and guidance from the IAM. IAMs vary in their asset management approaches, from active managers who select individual stocks and bonds for clients to more passive strategies that utilize funds in line with the asset allocation for clients. IAMs also offer recommendations on alternative investments, including hedge funds, private equity, commodities, and real estate. IAMs have open architecture platforms, meaning that they source suitable products from a range of providers to fit client profiles and needs rather than building and offering in-house products.

In addition to asset management, IAMs advise clients on wealth transitioning matters, such the use of companies, trusts, and life insurance policies. IAMs utilize their networks to select appropriate partners for clients for these and other services. In other words, they employ a horizontal approach rather than the vertical one found in banks, where in-house specialists and departments work along many product and service lines. IAMs also focus on cost management and consolidated reporting for clients. Some IAMs provide corporate advisory advice for large clients, and certain IAMs work with large families and provide a range of services to help them manage their personal wealth, business activities, and family dynamics and governance.

The Swiss IAM Value Proposition

IAMs vary in terms of their size and focus, but their value proposition is similar: as contrasted/compared to banks, they offer independence, alignment of interests with clients, and personal service. IAMs represent clients and are designed to advocate for their interests and manage their assets and to advise them in a professional, personal, and objective manner.

IAMs work with custodian banks that house and administer client assets, i.e. custody services. More than half of Swiss IAMs work with up to 5 custodian banks, another quarter with 6-10 banks, and the rest with more than 10 banks. No client assets are housed by IAMs, and IAMs may not operate balance sheet services for clients such as deposit taking and credit extension. As a result, there is no risk to client assets in the event an IAM experiences business difficulties.

The table below outlines key aspects of the value propositions for IAMs and banks. Banks and IAMs vary in their offerings and capabilities, and the table is meant to be illustrative, and to capture the key elements in common. Banks are more typically generalists, with a broad client focus in terms of geographies and needs, while IAMs are increasingly becoming more specialized in particular client segments and geographies, with IAM staff and expertise aligned accordingly.

The Swiss IAM Industry in a Comparative Context

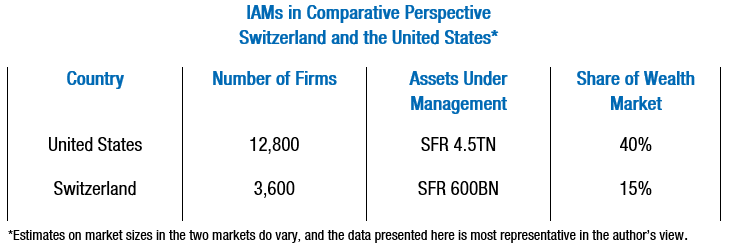

Independent Asset Managers have come to represent a significant presence in the wealth management industry. In the United States they are called “Registered Investment

Advisors“(RIAs), in the United Kingdom “Independent Financial Advisors“(IFAs), and in Switzerland “Independent“ or “External“ Asset Managers (IAMs / EAMs). In each of these large marketplaces, they have made an impact and grown in size.

The US IAM sector is the largest and most developed in the world, with IAMs in the US representing nearly half of the overall wealth market. The US IAM market is also more developed in terms of sophistication, infrastructure and established fiduciary standards. The Swiss IAM sector is growing in size, and is also becoming more developed as well. In the US, the main competitors to IAMs are the brokerage firms, and IAMs have steadily taken market share from them. In Switzerland, the chief competitors are the private banks.

Switzerland’s IAM progress, while still behind the US, is taking place in parallel with strong IAM growth in Asia, and continued growth of a vibrant IAM sector in the UK, which has as many IAMs as the US though lower levels of assets under management (AUM), and a generally high level of sophistication and fiduciary standards. The growth across geographies is a testament to the IAM value proposition.

The Swiss IAM Industry in More Detail

The growth of the IAM sector in Switzerland has been primarily focused on clients from Western Europe, although in more recent times there has been diversification into and growth in other markets, notably emerging markets. The IAM sector accounted for only 5% of the Swiss wealth market in 1998, versus 15% today, with 1,600 IAMs in 1998, compared to 3,600 currently. Today, IAMs are growing larger and building in-house infrastructure to support growth and to attract bankers leaving private banks. Swiss IAMs have in common with their counterparts in other countries a focus on independence and personalized service, but also a growing level of regulatory oversight.

Growth in the IAM sector in Switzerland is accompanied by positive sentiment and optimism by the IAMs themselves. WealthBriefing, a leading media group focused on the wealth management industry, created a “Swiss Sentiment Index“ and found in 2014 strong optimistic sentiment from IAMs for business growth and hiring going forward, with positive expectations that assets under management would continue to increase.

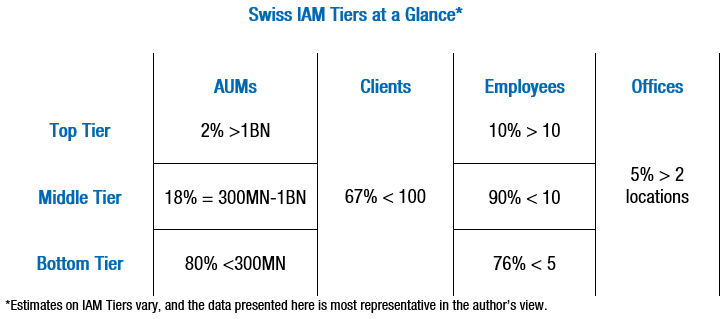

When we look at the distribution of firms in the Swiss IAM sector, we find that the 80/20 rule generally applies. Most IAMs are small in terms of people, assets, and with single offices. It should be noted that this distribution is similar to that in other countries. In the US, for instance, 15% of IAMs manage more than USD200M in assets, and just 3% more than 1BN. The reason for most IAMs being small is that they were created to serve specific client bases and focus on advice and solutions. They were not designed to build scale and infrastructure, but rather to leverage custodian bank services and their partner networks.

How Do You Know Which One to Choose?

It’s the question we always get asked once we’ve laid out the fundamental definitions, and it’s one which really doesn’t have a one-size-fits-all answer. Both brokerages and custodians have their merits, so let’s take a look at each of them in turn so you can see where the balance lies. If we keep things simple and avoid any in-depth case studies, you should be able to determine which approach is right for you.

Clients appoint IAMs to the custodian bank via the bank’s Third Party Management Agreement or through a Limited Power of Attorney (TPMA/LPOA). IAMs are limited to managing client assets through the transmission of orders to the bank for execution. IAM's are not authorized under the TPMA/LPOA to instruct the transfer of assets out of the client’s account, something for which only clients may provide an instruction. IAM's act as a central point of communication with the client, who usually does not communicate directly with the bank and vice versa

IAM agreements with custodian banks set out the roles and responsibilities of each party. Custodian banks today will not normally permit an IAM to be appointed by a client unless there is an IAM agreement in place between the bank and the IAM (an LPOA being an exception). Both custodian banks and IAMs are subject to the same high standards mandated by their regulators with regard to client anti-money laundering (AML) and know your customer (KYC), and the custodian bank delegates these responsibilities to the IAM under the agreement between them.

IAM's have historically had various fee arrangements with clients, primarily consisting of management fees directly from clients, and have also in some cases retrocession payments directly from custodian banks. For a number of years now, Swiss law has required custodian banks to advise clients of any payments it makes directly to IAMs, and also required IAMs to return those payments to clients unless clients elect not to receive them. As a result, retrocession payments by custodian banks to IAMs are quickly becoming a thing of the past, a positive development for clients in terms of increased transparency and more complete alignment of interests.

The Swiss IAM Regulatory Structure

Swiss IAMs are governed by the country’s Anti-Money Laundering Act and have to be approved either by the Swiss Financial Market Supervisory Authority (FINMA) or be a member of a recognized Self-Regulating Body (SRO). The latter approach is more common: today in Switzerland, about 75% of all IAMs are regulated by SROs, the rest directly by FINMA. If it is a member of an SRO, the IAM must adhere to the professional standards of the SRO. These standards correspond to official requirements and are approved by FINMA.

The SRO monitors adherence to professional standards and statutory duties of care and conduct in relation to preventing and combating money laundering and terrorism financing. It assesses any rule violations. IAMs must agree to comply with the SRO’s code of ethics and professional conduct for the practicing of independent asset management. The SRO, therefore, makes a significant contribution to upholding the industry’s reputation and protecting investors. Of note here, in its third round of mutual evaluations of member countries, the Financial Action Task Force (FATF) determined that the Swiss system of self-regulation in the area of anti-money laundering was appropriate and comparable to a system of state regulation.

IAMs may operate in certain niches that require additional regulatory oversight beyond the Swiss level. One example is the US-person business, which requires IAMs that serve US resident clients to register with the SEC and to be subject to SEC oversight, in addition to Swiss regulatory oversight. In Switzerland today, there are approximately 40 IAMs that operate in the US-person niche and need to comply with these regulatory requirements. Swiss custodian banks require IAMs to be SEC-registered to work with all US persons, residents and non-residents alike

The Future for IAMs in Switzerland

There is broad agreement that consolidation in the IAM sector in Switzerland is inevitable. The regulator is raising the bar on due diligence levels that IAMs must satisfy, and custodian banks are themselves becoming increasingly strict about due diligence and also about minimum asset levels that IAMs must reach. In addition, IAM founders in certain firms are ageing and are looking to sell or transition their practices for liquidity and/or personal reasons.

Swiss IAMs must respond to these headwinds. In order to preserve their central focus on serving clients, IAMs that do not wish to focus attention and resources on their platforms and infrastructure will need to join with groups that have platforms in place or have the plans and resources to build them. At the same time, IAMs are facing more intense competition from banks, other IAMs and also wealth managers outside of Switzerland, as clients grow in sophistication and discover additional options.

As IAMs adapt to these environmental changes and competitive challenges, they will cling to their value proposition of independence, aligned interests, and personal service.As a result, consolidation in most cases will not hinder the client experience, but rather enhance it as independent advisors remain fully focused on their clients and can operate on robust platforms and systems, giving them better tools to analyze client situations and create robust solutions.

Select Materials and Data Sources Used

Aite - http://aitegroup.com

APFA – Association of Professional Financial Advisors (UK) - http://www.apfa.net

BCG - http://www.bcg.com

Booz & Company (renamed “Strategy&“) - http://www.strategyand.pwc.com

Cerulli - https://www.cerulli.com

FINMA - Swiss Financial Market Supervisory Authority - https://www.finma.ch/en/#Order=4

Individual Swiss IAM company reports and brochures (various)

RIABIZ (US) - http://www.riabiz.com

RIA Database (US) – http://www.riadatabase.com

WealthBriefing (subscription service) - http://www.wealthbriefing.com